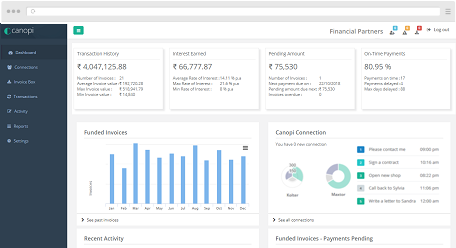

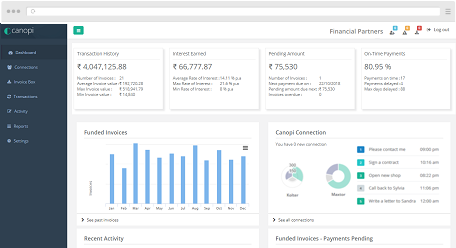

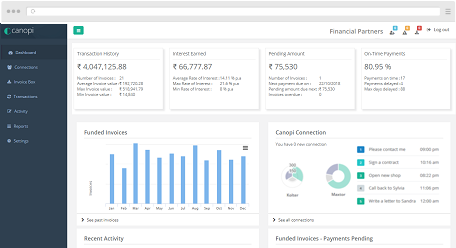

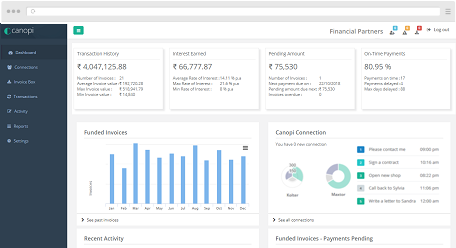

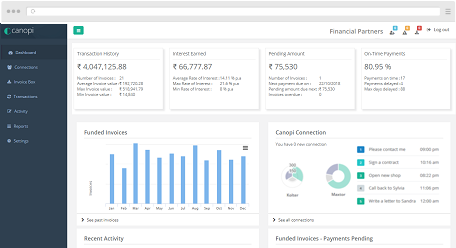

Modern, End-to-End & Integrated Supply Chain Finance platform - where Financial Institutions, Corporate Customers, Vendors/Dealers and Channel Partners can collaborate.

Supports Vendor Finance, Channel Finance, Factoring, Reverse Factoring, Purchase Order Finance, Dynamic Discounting & Direct Payment all on a single platform.

Supports configurations & Workflows for setting up and managing Supply Chain Finance programs with Limit on Corporate or counterparty

Invoice upload modules via File Mode, API mode and direct integration with Vendor Management/Dealer Management portals

Customer MIS Reporting, Regulatory Reporting, Customer statements, Payment reminders all available via a self service portal. Subscribe/unsubscribe to Notifications available for end customers

Support deployments or On-premises deployments via containerized workloads.

APIs for Transaction Banking, Lead Generation, Masters Management & Payments with support for Webhooks.

Microservice based architecture can scale on demand.

Out of the box connectors for GST integration, Income Tax Portal and Ministry of Corporate Affairs (MCA) database, Account Aggregators and Credit Bureaus.

Network architecture vetted by multiple banks for on-premise and cloud deployments, plug and play modules to integrate with Enterprise Service Bus (ESB) of Financial Institutions. Supports Microsoft AD integration and Customer Internet Banking (CIB) for Single Sign On (SSO) experience.

Faster go to market with built in integrations. Low Code No Code (LCNC) platform for faster turnaround of new product requirements.

Save time, prevent errors and avoid manual entry via our direct integration solutions

For queries, feedback & assistance

General: info@canopi.in | Sales: sales@canopi.in

Support: support@canopi.in | Jobs: jobs@canopi.in